Chime is a futuristic banking solution app that makes banking easy. You can do everything from depositing a check to sending money to your friends through Chime. Founded in 2012, it’s rising and gaining more users daily. If you are planning to create an app like Chime, then you should check out how it’s currently performing.

Moreover, if you want to get a detailed insight into Chime then you are at the right place, we a leading Finance app development company have done the leg work for you and compiled a list of Chime statistics that you must have a look at. So, let’s dive deep into it and check the content of this post:

What Is Chime?

Chime is a fintech startup that provides users with an app that includes banking services. Chime is not regarded as a financial institution but as a neo-bank. It offers its customers debit cards, no-fee checking and savings accounts, and other financial services in collaboration with two banks.

Chime Overview

| Year Founded | 2012 |

| Owners | Chris Britt (co-founder, CEO), Ryan King (co-founder, CTO) |

| Industry | Fintech (Online banking) |

| HQ | United States, California, San Francisco |

| Category Rank | #13 |

Chime Key Statistics 2024

- Chime had $1.5B in revenue in 2023.

- Chime has 14.5 million users and most of them use the primary banking app feature.

- Chime is ranked #13 in the fintech industry category.

- 95% of the traffic on Chime is from the US.

- The 35-44 age group uses the Chime app the most compared to other age groups.

- Chime is only available in the US and they don’t plan to extend their operations to any other country.

- According to a report from Bloomberg, Chime targets public listing by the end of 2025.

Chime Products

Chime provides consumer banking products via its cards and mobile app. Among Chime’s offerings are:

- Debit card and checking account: A debit card that can be used at more than 60,000 ATMs and has no monthly, low-balance, or overdraft fees.

- Credit builder account: A prepaid account that is financed by transferring funds from a checking account. Chime then reports these transactions to credit bureaux to establish the credit history of the customer.

- Savings account: An account that offers a 2% annual percentage yield (APY) without any fees; regular banks only give 0.01%.

- Money transfer: A fee-free option like Venmo that allows users to send and receive money from bank account holders with or without Chime.

Chime Usage Statistics

Chime Monthly Visitors

- There were 13.2 million visitors in April 2024 which was 1.1M less than March 2024.

| Month (2024) | Visitors (mm) |

| February | 13.4 |

| March | 14.3 |

| April | 13.2 |

Source: Similarweb

Chime Annual Visitors

- Since 2017 Chime has gained 21.8 million users. They had a traffic of 0.5m in 2017 and 22.3 Million users in April 2024.

| Year | Total Traffic (mm) |

| 2017 | 0.5 |

| 2018 | 1 |

| 2019 | 5 |

| 2020 | 10 |

| 2021 | 12 |

| 2022 | 14.5 |

| 2024 (April) | 22.3 |

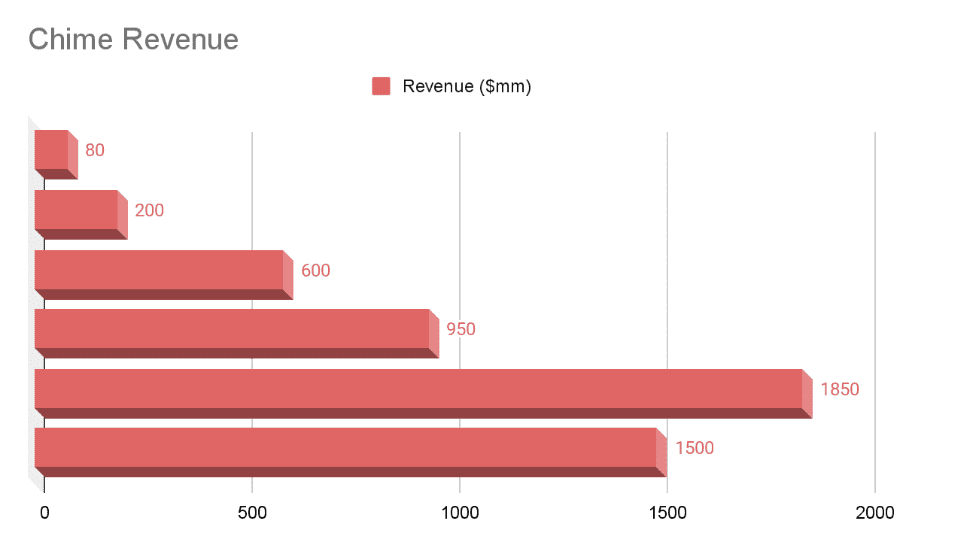

Chime Revenue Statistics

- In 2019, Chime’s valuation significantly increased to $5.83 billion from its initial $0.52 billion valuation.

| Year | Revenue ($mm) |

| 2018 | 80 |

| 2019 | 200 |

| 2020 | 600 |

| 2021 | 950 |

| 2022 | 1850 |

| 2023 | 1500 |

Source: The Information, Sacra

Chime Valuation

- At the height of investor interest in fintech companies in the summer of 2021, Chime was valued at $25 billion.

| Year | Valuation ($bn) |

| 2018 | 0.5 |

| 2019 | 5.8 |

| 2020 | 14.5 |

| 2021 | 25 |

Source: BusinessOfApps

Chime Growth Rate Statistics

- Chime is growing at a rate of 30% (2023).

Chime Demographic Statistics

Chime Age Distribution Statistics

| Age | Traffic (%) |

| 18-24 | 8.41 |

| 25-34 | 23.35 |

| 35-44 | 26.49 |

| 45-54 | 22.32 |

| 55-64 | 13.1 |

| 65+ | 6.33 |

Source: Simmilarweb

Chime Gender Distribution

- 59.56% of the visitors to Chime are female and the rest 40.44% of the users are male.

Source: Similarweb

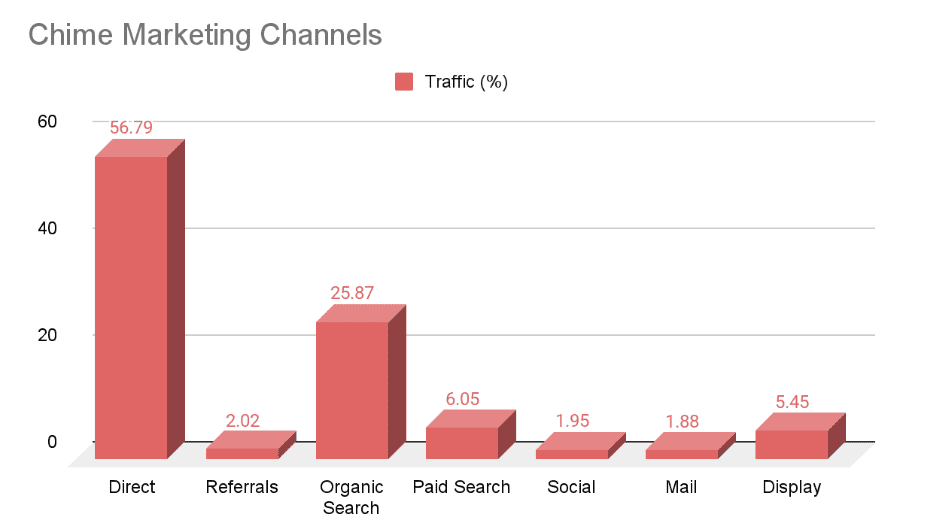

Chime Marketing Statistics

| Marketing Channel | Traffic (%) |

| Direct | 56.79 |

| Referrals | 2.02 |

| Organic Search | 25.87 |

| Paid Search | 6.05 |

| Social | 1.95 |

| 1.88 | |

| Display | 5.45 |

Source: Similarweb

Chime Organic V/S Paid Traffic

Chime’s 81.05% of visitors are through organic search and the rest 18.95% are from paid marketing.

Chime Social Media Traffic

- LinkedIn (38.9%) drives the highest traffic on Chime followed by Youtube (26.27%).

| Channels | Traffic (%) |

| 38.9 | |

| Youtube | 26.27 |

| 19.65 | |

| 7.5 | |

| 4.35 | |

| Others | 3.33 |

Source: Similarweb

Chime Reviews

- Chime has 4.6/5 reviews out of 70 total reviews cast on GetApp. Thus we can say that Chime is a user-friendly and easy-to-use application.

Chime Competitors

Chime V/S Cash.App

| Factors | Chime | Cash.App |

| April Traffic | 13.2M | 24.2M |

| Category Rank (Finance) | 13 | 6 |

| Highest Social Media Traffic | LinkedIn (38.9%) | Youtube (28.06%) |

| Revenue | $15Bn | $14.4Bn |

| Valuation | $25Bn | $138Bn |

Conclusion

Through the above-listed stats, we can clearly say that Chime is growing at a great pace. However, if you are planning to launch an app similar to Chime and looking for a finance app development company then you are at the right place.

Appic Softwares is a leading fintech app development company that has worked with several enterprises such as Aavas Finance and can be a great fit for you too.

So, what are you waiting for?

Contact us now and get your app like Chime ready in no time!