Egypt in particular has risen to the fore in the Middle Eastern country’s digital transition since COVID. To maintain Egypt’s status as a leader, the government has introduced several efforts over time, such as expanding its ICT infrastructure, encouraging digital inclusiveness, and improving cybersecurity practices.

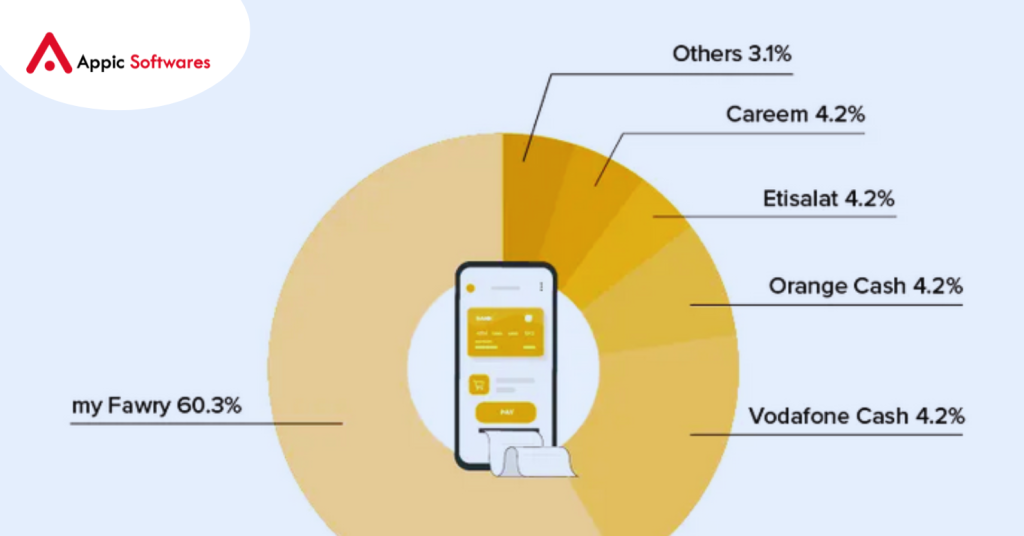

Several tech-focused businesses have emerged to support these digitalization initiatives. Egyptian startups raised approximately $491 million across 147 deals, with 17% of that amount going to the Fintech sector alone, serving as proof of this. During the same period, myFawry, Egypt’s largest financial services provider, rose to prominence and eventually attained Super App status.

If you are planning to build a fintech app similar to myFawry and looking for solutions then you are at the right place. Here we have listed all the information related to myFawry app development that you must check out

What Is myFawry App?

MyFawry is a Fintech-focused mega app that lets users pay, invest, borrow, spend, and earn incentives all within the application. Through its channels, which are operational in more than 225,000 locations across Egypt, the brand provides a variety of financial services to both consumers and companies. MyFawry, which reached a value of over $1 billion in 2020, became Egypt’s first unicorn as COVID-19 pushed the adoption of digital payments.

MyFawry’s popularity has led to several businesspeople attempting to create business plans for apps that are comparable to myFawry. We will get into the specifics of the development costs of payment platforms like myFawry in this post along with all of its various components.

On average, the cost of developing an online payment platform can range from $180k to $220k, depending on a wide variety of elements, including design, features, the number of platforms, tech integrations, and team size. To gain a thorough grasp of the application development process and its costs, let’s examine each one in turn.

Must-Have Features For Your Fintech App

The feature sets on which a custom payment platform is developed have a significant impact on its success. Here are the features of the fintech app that you must have

-

A Utility Bill

MyFawry has worked with several national power, gas, and water providers to make it simple for users to pay their bills through the app without having to deal with long queues.

-

Bill payments and recharges

According to the primary goal of payment platform development, the program makes it simple for users to pay bills and top off their phone, home internet, and internet service with just one click.

-

Subscriptions

When creating a website like myFawry, it is crucial to make it simple for customers to pay for club subscriptions. The company has partnerships with over 20 exclusive clubs in Egypt, whose members may easily renew their dues using the app.

-

Donations

gifts are an important tool for reducing taxes because they are entirely deductible for gifts to the Egyptian government but only up to 10% of taxable income for donations to local charities. MyFawry app users can donate to a variety of charities throughout the country to support this journey.

-

Payments for insurance

Easing insurance payments is another crucial aspect to take into accou

nt when developing payment platforms. The borrowers may easily pay their EMIs through the app, examine their insurance information, and even buy an insurance plan.

-

Educational Costs

In Egypt, the myFawry brand is connected to more than 40 universities. Students can use the app to manage a variety of expenses, including tuition and test fees.

-

Credit cards

The user retention techniques you employ will determine if your version of an app like myFawry is successful over the long term. Having a gift card option where users can send personalized cards with app-specific perks is a surefire way to go about it.

-

24-hour client service

Through the in-app AI-powered chat system and email, the application makes it simple for users to get in touch with the company with their questions and complaints.

-

Spending monitoring

It is beneficial to have a spending tracking tool in an app like myFawry so that users can keep track of their current spending and upcoming payments. The functionality makes it simple for customers to keep track of their spending and better plan it when it is displayed understandably.

These features are very tightly constrained and are listed in an app like myFawry. Based on the company strategy you select, they have a range of expansions. Whatever set of payment platform features you ultimately decide on, it is imperative to remember that they should be developed with the technological viability and pain points of the target audience in mind.

The program offers distinct use cases for consumers, businesses, and merchants, yet for the sake of this post, we solely concentrated on the consumer side of the myFawry payment platform development. Look them up on the Fawry for Business page to learn more.

The next step in the creation of the payment platform is to create the design system after the features have been finalized.

How To Create A Design System Similar To myFawry?

It might be difficult to create a user experience that not only converts consumers into customers but is also intuitive. When designing a payment platform, we at Appic Softwares pay particular attention to minimizing the content on the displays to a minimum and emphasizing the important elements with brand colors. The in-app user flow is also made highly organic by our designers’ use of icon designs and text formats, which results in a quick learning curve.

Based on the selected feature sets, the design system that is established at this step aids in the creation of a wireframe that is then given to the developers for developing a clickable MVP. Let’s see what comes next in that step.

Development Cycle Of myFawry Clone?

The development of a payment platform like myFawry involves several stages. The creation of the front end and back end comes after the feature selection and design stage, which we have already attended.

The technology stack would change depending on the platform you decide to build your fintech app for — in the case of myFawry, it’s Android, iOS, and web. For fundamental user activities like KYCs, sign-ups, and integrating the financial ecosystem, you will also need to integrate several APIs in addition to the platform-specific tech stack combinations.

Cost Of Creating An App Like myFawry

| Requirement gathering and validation | $25-30K |

|---|---|

| App wireframe and design | $35-42K |

| App development | $80-120K |

| App testing | $20-30K |

Let’s talk about some methods to make your version of an app like myFawry an update now that you have an idea of what to anticipate from it, such as the approximate development cost of an online payment platform.

How You Can Get An Edge Over myFawry?

Because they are aware of their clients’ needs, myFawry has established itself as a top payment platform. The company created an application that makes it simpler to do everything from invest and spend to make online payments after realizing there wa

s a need for cashless transactions.

Now, it’s critical to comprehend what is working for the application and what is not to gain an advantage and maximize your investment, which equates to the cost of developing a payment platform like myFawry.

What functions for the myFawry app

The service options included in the myFawry suite meet a variety of needs for fintech users. The design system they employ is very simple for users to use and remember organically.

In addition, the company has formed several strategic alliances with financial institutions, online retailers, schools, organizations, and other parties involved in particular features. Users will find it simple to utilize the program for a variety of use cases as a result.

How Appic Softwares Can Help You Build An App Like myFwary?

As a fintech app development company, we have experience working with a variety of financial solutions for both startups and established businesses.

Each app’s distinct nature has been the one aspect that has remained constant throughout all of them. For instance, we helped Asian Bank enter the cryptocurrency field with a crypto fintech platform and Watani created an online payment platform, ensuring that each of the apps gave its fair share of innovation to the users.

We approach developing financial software by thoroughly comprehending the consumer base and providing a technical solution to their problems. With this combination, we assist companies across the whole product lifecycle in addition to helping them validate their ideas.

Partner with Appic Softwares and get your app developed now.

FAQs

Q.) How can I create a payment platform similar to myFawry?

- A) The process of developing a myFawry-like app begins with gathering project requirements, developing a design system, coding the app’s front and back, conducting user acceptance testing to make sure the app functions properly, and lastly deploying the program across the target platforms.

Q.) What is the price of the myFawry payment system?

- Depending on a variety of variables, including the market, technological validation, features chosen, the number of platforms, design, development, testing, and deployment, the cost of developing an online payment platform can range from $ 180K to $220K.

Q.) How long does it take to establish a payment platform like myFawry?

- Depending on the same factors that affect how much it costs to construct a payment platform like myFawry, the time it may take for your version of the myFawry app to be ready for use could range from 6 months to potentially 18 months.

Conclusion

Now in the end we hope that through this post you were able to gain knowledge on how to create an app like myFawry. Here we have mentioned the cost and the best ways to create a similar app like myFwary.

However, if you are looking for a fintech app development company, then you should check out Appic Softwares, we have an experienced team of developers that can help you create an app like myFawry in no time.

So, what are you waiting for?