The global FinTech market is expected to reach $460 billion by 2025. Digital banking, mobile payments, and other FinTech services have made financial transactions faster, easier, and more accessible.

If you want to create a FinTech app, you must know the processes. This guide covers FinTech app development from ideation through launch.

Everything from market research through user experience design, technology stack selection, feature development, testing, and deployment will be covered. This guide gives startup founders, product managers, and developers the skills to build successful FinTech apps.

Let’s Learn How to Create a Fin Tech App!

What Is A FinTech App?

FintTech smartphone apps offer online banking, investment management, budgeting, and digital payments. FinTech apps simplify financial management for individuals and businesses through smart technology and innovation. These apps provide real-time account balances, transaction histories, and financial insights on smartphones, tablets, and other mobile devices. User-friendly interfaces, cheap costs, and time and money savings make FinTech apps popular.

Fintech app development involves creating a financial mobile app. Software engineering, user experience design, and financial expertise are used to construct fintech apps that suit consumers’ demands.

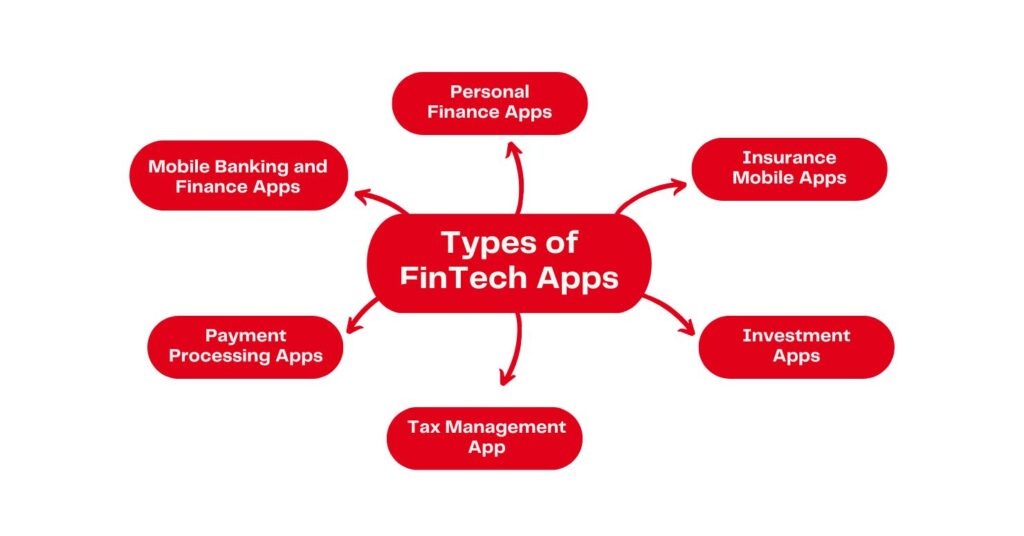

Fintech Mobile App Types

Blockchain, banking systems, and budgeting apps are fintech. To help your development grasp your idea, determine a product’s consumer worth. Fintech uses various apps:

1. Insurance Mobile Apps

The name implies that these insurance apps speed up claim processing, policy administration, and fraud reduction. It could be a basic CRM for an insurance website or a full-featured insurance app. A typical insurance app includes functionalities like payment processing, claims filing, generating quotations, managing policies, and searching for policies using specific parameters.

InsurTech’s reach extends beyond straightforward uses. To more accurately evaluate a person’s lifestyle and risk profile, it makes use of AI, smart wearables, and Internet of Things devices. Despite being a relatively new niche, insurtech is growing quickly. According to experts, the insurtech industry is expected to expand at a compound annual growth rate (CAGR) of 53.50% from USD 20.26 billion in 2025 to USD 958.85 billion by 2034.

2. Stock, Mutual Fund, and Investment Mobile Apps

Most stock market users use these apps. These apps enable users to research investment opportunities, manage assets, and enhance the overall efficiency of their investments. An investment app must contain multi-currency, savings, credit management, asset comparison, real-time notifications, and client support. Some investment app ideas:

Robinhood is a trading app providing quick stock page access, instant delivery of the first $1000 deposited into the account, and a news blog channel.

How To Create A Stock Trading App

3. Mobile Banking and Finance Apps

Bank apps let consumers manage their accounts and verify financial activities without visiting the bank. Since customers prefer mobile phones for financial transactions, banks favor mobile apps.

Banking apps support Google Pay, Apple Pay, and PayPal. The best e-wallet app references are:

Starling Bank Customers can open Starling accounts without fees or documentation. They can budget, handle overdrafts and savings, and transfer funds.

Banking and lending apps offer all the services you would find at a physical bank, including opening accounts, checking and managing balances, transferring funds, making mobile payments, and applying for loans.

4. Payment Processing Apps

All transactions are managed by payment processing apps for the FinTech app development company. They act as a middleman, facilitating online and mobile payments by bringing together payment service providers and customers’ payment details.

In addition to improving client convenience, payment processing blends in precisely with a conventional e-commerce ecosystem. These apps make it possible for small businesses to use credit and debit cards as well as other online payment options.

5. Personal Finance Apps

These apps may not process payments, help users save money, and budget, and predict future expenses to avoid overspending. These apps usually provide financial goals, bill tracking, investment analysis, fraud warnings, etc. Considerations for consumer finance apps:

This free software includes Mint Budget, payment tracking, and enrollment monitoring. You can sync credit cards, bank accounts, and PayPal.

The Money Patrol helps you manage your transactions, savings, and finances; identify fraud; and more.

6. Tax Management App

Taxes are often the most difficult aspect of finance. The rules and fine print are challenging to understand, which increases the likelihood of error. Different income tax rates for individuals and organizations, tax benefits, and changes in legislation can be confusing.

The complexity of tax systems worldwide makes tax management software essential for efficiently filing and managing taxes. FinTech companies create applications to simplify the process of preparing, submitting, and controlling documents. You don’t need to hire an accountant or have any experience, as automation handles almost everything.

Fintech App Development Features

1. Create A Properly Secured Application

Fintech apps need registration to let users create accounts and use their features. Registration should be easy, secure, and compliant with banking requirements.

2. Innovation Through Artificial Intelligence

Personal accounts are vital to fintech apps because they let users manage their funds, track transactions, and access additional financial services.

3. Blockchain Fintech Solution

It allows secure transactions. It connects users to payment processors to transfer funds from their bank accounts to recipients’ accounts.

4. Multiple Payment Gateways

By adding this functionality to your fintech app, you can give customers a complete financial management solution to help them reach their goals.

5. Transaction and Interaction History

This feature records all app-related financial transactions and interactions to provide a complete financial history. This tool displays prior deposits, withdrawals, payments, and purchases. They can also view transaction dates, times, amounts, and account balances before and after transactions.

6. System Onboarding

The Onboarding System enables Fintech apps to swiftly onboard new customers and get them using their financial services.

7. Chatbots

A chatbot in a fintech app can help financial organizations enhance customer assistance, cut expenses, and analyze client wants and behaviors.

Advanced Features

1. A Biometric Scan

Biometric scanning can improve fintech app security, user experience, fraud prevention, compliance, and data analysis and optimization.

2. Two-Factor Authentication

Users can implement this functionality in many ways to suit their tastes.

3. KYC

This capability also helps fintech organizations learn client wants and preferences to deliver customized services and products.

4. Cashback

Customers can get a percentage of their purchase price back by utilizing the app. This encourages people to use the app for financial transactions and boosts loyalty.

5. Scanners and QR Code

Adding a card scanning capability to a fintech app lets clients quickly add payment cards.

Major Fintech App Development Needs

Since the Fintech industry is complex, you must first analyze the elements that will help your firm prosper. Here are some key Fintech App Development features:

1. Security

In fintech, security comes first. Users will remove your software without hesitation if they encounter security difficulties. The following key elements enhance the security of a fintech app:

- Two-factor authentication

- Ensure security with fingerprint or facial recognition.

- OTP Login

- CVV2 Dynamic Codes

Secure your system with app penetration testing. You will learn how hackers can break into your app and brainstorm ways to avoid it. You should also update, manage, and secure the app.

Remember, Fintech has restrictions. Developing a fintech app requires compliance with PCI-DSS, PSD2, FCA, and privacy legislation including CCPA, GDPR, and PIA. Implement security early in Fintech app development.

2. Integrations

APIs are the backbone of financial apps, enabling seamless integration and efficient communication between different systems and services. This also connects apps and portals. APIs can command 3rd-party service workers in fintech.

API is economically favorable. This fintech startup will connect apps to bank accounts if you use the Plaid API. Users can check balances, make payments, and more with their bank accounts.

APIs streamline e-commerce payments and checkouts. Your fintech software can link with PayPal, Braintree, Stripe, etc., so users can shop worldwide.

3. Simplicity

To ensure the success of your fintech app, keep it straightforward and user-friendly, making it easy for users to navigate and utilize its features. Fintech app development creates interface-friendly analytical tools for financial data collection and program creation.

Users or corporations may easily see their revenue, expenses, savings, etc., through real-time analytics and statistics. Simple, understandable fintech apps attract more users.

4. Support

The whole fintech sector uses confidential data. Thus, you must use consultants to address consumer inquiries rather than third parties. Workers need technical training to follow strict safety guidelines.

Consider creating a chatbot if hiring a 24/7 finance app developer isn’t feasible. Thus, customers can trust your app and learn about their money or bank offers.

Fintech App Development Phases

Fintech app development requires advanced technological skills. Hire a finance app development company with experience building such apps. Learn about Fintech app development’s main stages. Stages are:

1. Select Fintech Niche

Choose a fintech speciality first. After assessing the target market, you can determine whether to design a fintech solution from scratch or upgrade an existing one by adding features, UX, etc.

Develop a complicated Fintech solution to survive in the competitive Fintech industry. You must stand out. After choosing a niche, legalize the app.

2. Ensure Compliance

From the start of your app, you must examine various Fintech legalities. KYC and AML track compliance. To protect and limit access to consumers’ financial data, follow privacy rules (CCPA, GDPR, LGPD, PIA).

Privacy laws vary by country, and some have no particular regulatory organizations. You must consider regional requirements for your audience. In the US, there is no fintech regulation, but you must follow various state and federal rules. You must follow legal standards, or authorities may question you.

3. Features Consideration

The type of Fintech app determines its functionality. Assess your audience’s needs. You can build a Fintech app from an existing solution and improve it. You may want to consider incorporating the following common features into your app:

- Secure login options such as fingerprint, face, or voice recognition

- Push notifications for updates and alerts

- Budgeting and savings tracking tools

Features of the app include money transfers, digital payments, and balance checks. Users can also scan QR codes and card numbers for easy transactions. The app provides support through an AI-powered chatbot or virtual assistant. Additionally, it offers non-traditional financial services such as gift cards, donations, cashback, deals, and special offers.

4. Form a Development Team

For Fintech app development, outsourcing is the best option because it saves time and money and provides a team of highly skilled developers. They will answer all your questions and meet all scope criteria.

Team size depends on schedule, technology, and project size. For example, a cross-platform Fintech app for iOS and Android requires Flutter or React Native developers. Development will take longer, but you’ll get two apps for two platforms. The Fintech app development team includes these.

- 2 Frontend/Backend Developers

- The Business Analyst

- A Project Manager

- Designer

- QA Expert

Check the company’s fintech experience, hourly rates, and developers’ experience before hiring a team to develop your app. Communication with the project manager is crucial; therefore, language fluency helps.

5. Fintech App Design

After ensuring security, the design of your app will play a crucial role in attracting and retaining users. Design something beautiful but straightforward for easy usability.

If you’re developing a banking app, avoid creating lengthy forms that users will find difficult to complete for bill payments. Users should be able to transfer money or pay bills without entering payment details.

6. Create An MVP

MVP development is a fantastic way to determine if your idea will sell. MVP includes app basics and development without extra expenditures, saving money. With commercial success, you can add sophisticated functionality to the program.

7. Analysis of Quality

After your app launches, things continue. You must undertake A/B testing to assess customer reviews before adding new sophisticated features and improving existing ones.

If you want to trail your competitors, your Fintech app should be smooth, safe, and user-friendly.

See also: Mobile App Development Cost

Top 2025 Fintech App Development Trends

Some of the biggest fintech app development trends for 2025 are:

1. Integrating Blockchain Technology and Sustainability

Over time, more fintech apps will employ blockchain to boost security and transparency. As environmental concerns develop, more fintech apps will include sustainability into their business models and services.

2. Personalization, AI-Powered Features

Chatbots and virtual assistants that provide financial advice will make fintech apps more personalized.

3. Expanding Open Banking and Biometric Use

Open banking gives third-party developers financial data. More fintech apps will use open banking APIs to provide value. Fintech apps increasingly incorporate biometric authentication like facial recognition and fingerprint scanning for security and simplicity.

4. The Rise of Decentralized Finance

Over time, more fintech apps will adopt decentralized finance (DeFi), which provides financial services without intermediaries.

Follow these trends to remain ahead of the curve and fulfill consumers’ changing needs with creative financial app solutions.

How To Build A Fintech App

1. Generate Your FinTech App Idea

You need to think things through before you start developing the app if you want to stay in the FinTech sector for a long time. You should ask yourself these questions as you brainstorm. Once everything is clear, present your mobile app concept to a finance app development specialist. Consider developing your app based on the finest FinTech apps as a guide. Our professionals can offer the advisory services you require while you prepare to launch your startup to guarantee a successful launch. Schedule a free consultation to receive comprehensive advice on launching and growing a business.

2. Analyze The Project and Gap In The Market

Market research must be conducted to identify the kind of future application and monetization strategy. After defining the budget and timelines, pay close attention to the project evaluation.

Analyzing your app’s target user base is also necessary at this point. Decide the audience segment you want to focus on. Investors who are new to the Bitcoin market or those who want to monitor their finances and observe where their money is going may be among them.

3. FinTech Mobile App Development Design

When it comes to attracting consumers’ attention and boosting user engagement, the design is crucial. When creating a mobile app’s front end, some important considerations are the app’s colors, style, and feel. Building and developing user-engagement components is the next stage.

The goal of front-end software development is to satisfy user needs while delivering a smooth and satisfying user experience.

To improve the user experience, for example, while developing a FinTech app, concentrate on creating an intuitive and user-friendly UI. Present charts and numbers in an interesting manner. Avoid making things too complicated for users. Make your app’s design user-friendly.

4. Test The App

Make sure to review and test the fintech app. A test run will allow you to check all areas of the application’s functionality and avoid bugs in future operations.

Check that the app works at multiple resolutions. When releasing a FinTech app for both iOS and Android, it’s crucial to ensure compatibility across all mobile platforms. Develop your content for smaller represents to avoid overcrowding and provide a clean, understandable structure. This secures the success of your fintech application.

5. Launch and Get Feedback

After launching the fintech app, gather feedback from users. User feedback is crucial for improving the solution and identifying features that should be added, removed, or modified. Improvements can involve fixing bugs or enhancing the app’s functionality. Maintaining communication with users and making the application more convenient, safe, and functional is important.

How Does Appic Softwares Support FinTech App Development?

Appic Softwares, a renowned Southeast Asian mobile app development solution, has developed Fintech apps for nearly 10 years. We sign a well-structured NDA with our clients, thus we can’t discuss our work.

Our competent and experienced mobile app developers, project managers, QA analysts, designers, and other team members will create an amazing Fintech app and help you with the initial business consulting. Let us know your needs.

FAQs

1. How Much Does It Cost To Make A Fintech App?

Creating a fintech app typically requires an investment ranging from $20,000 to $200,000, depending on your ambitions and complexity. The cost depends on crucial elements like regulatory compliance requirements, security infrastructure, and whether you’re building for iOS, Android, or both platforms.

2. How Long Does It Take To Make A Fintech App?

Building a fintech app’s timeline varies significantly based on its complexity and features, typically ranging from 4-12 months for a fully functional product. A basic fintech app with essential features like user authentication, payment processing, and basic financial tracking might take 4-6 months to develop.